If you don't have

life insurance

yourself, odds are good that you have heard of it. It's a common tool used in financial planning and estate planning, and it's also often included in employee benefit packages. Despite the fact that life insurance is widely available, many people don't know much about what it is or how it actually works. Here are ten things everyone should know about life insurance.

1. Life insurance is a contractual agreement

When you apply for a life insurance policy and that policy is issued, you are entering into a contract with the insurance company. You agree to pay premiums to keep the policy in force. In exchange, if you die while the policy is in force, the insurance company will pay the policy's death benefit to your named beneficiaries. Your rights and responsibilities, and the insurance company's rights and responsibilities, are spelled out in the policy document.

2. Life insurance contracts involve four parties

There are actually four different roles involved in life insurance policies:

-

The insurance company issues the policy

-

The owner is the person who has the responsibility to make premium payments and the rights to exercise policy options

-

The insured is the person whose life is used when determining policy premiums and upon whose death the policy benefits will be payable

-

The beneficiaries receive policy proceeds if the insured dies while the policy is in force

The owner is often the same person as the insured, as is the case when someone takes out a policy on their own life.

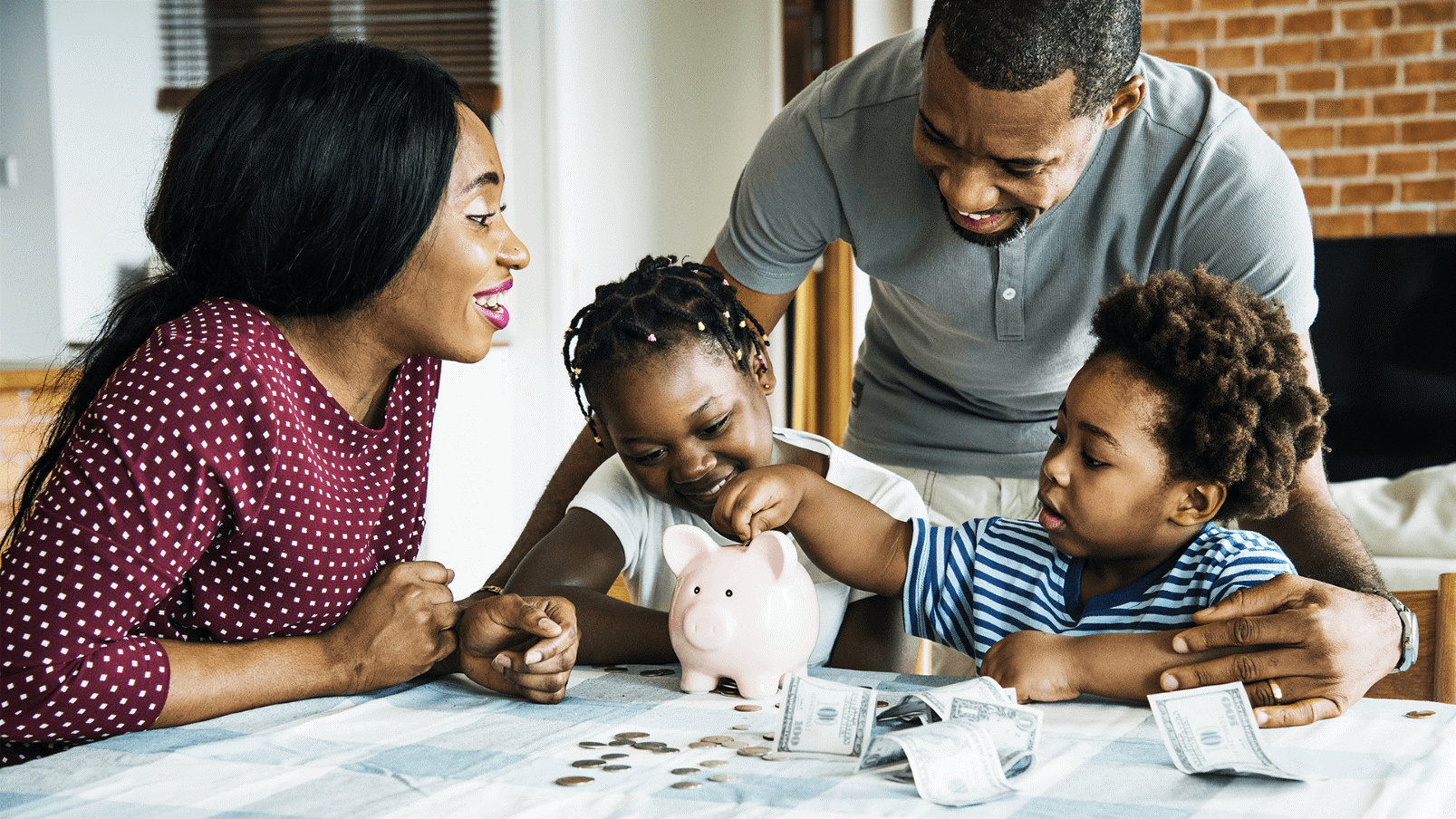

3. Policy benefits can protect your loved ones

If you have financial dependents, such as a spouse, partner, minor children, or others, you probably need life insurance to help protect them. If you were to die prematurely, life insurance proceeds could allow them to continue their current standard of living without making drastic life changes.

4. Life insurance is about risk management

While some types of life insurance policies include investment components, at its core, life insurance is a risk management device. Policies with cash value and investment features can add value to your savings and investment strategies while providing you with valuable insurance protection at the same time.

5. There are two main types of life insurance

There are many different types of insurance policies, riders, and optional coverages. However, don't get overwhelmed by all of those choices. There are essentially two main types of coverage.

Term insurance

is coverage you buy for a set period of time, and

permanent insurance

is coverage designed to protect you throughout your entire lifetime, as long as you keep the policy in force.

6. Life insurance proceeds can be used for anything

Sometimes, there's a misperception that life insurance proceeds can only be used to pay for

final expenses

like a funeral, burial or cremation. While insurance is often used for those expenses, it can also be used to pay off debts, make up for lost income, fund children's education expenses, and more. Your named beneficiaries can use policy proceeds for any type of expense.

7. Death benefits are generally income tax free

Life insurance proceeds paid to your beneficiaries are generally free of federal and state income taxes, meaning that money can go further than a taxable inheritance. For example, if you buy a $100,000 term insurance policy and keep it in force, your beneficiaries will receive the entire $100,000

death benefit free of taxes

when you die.

8. Life insurance is not always expensive

People sometimes shy away from seeking life insurance coverage because they think they won't be able to afford the coverage. However,

life insurance can be surprisingly affordable.

The price you'll pay depends on a number of factors, including your age and health when you apply for coverage, and the type of policy and policy options you choose. Your insurance agent can help you find coverage designed to fit your budget.

9. Life insurance can help with advanced planning

Beyond its primary use providing death benefits to pay final expenses and to help keep beneficiaries on solid financial footing after a loved one's death, life insurance is also a powerful tool that can help provide liquidity to pay anticipate estate tax obligations, create a charitable legacy after your death, fund business buy/sell agreements, and more.

10. An insurance professional can help you find the right coverage

In today's do-it-yourself world, you may be tempted to shop for life insurance coverage on your own. However, working with a licensed insurance agent can provide value that's hard to get on your own. Your agent can help you determine how much coverage you need, shop for policies, explain complex terms and concepts, and help ensure your needs are being met.

Need life insurance? Symmetry Financial Group can help!

If you want to learn more about how to protect what's most important to you, your Symmetry Financial Group Independent Insurance Agent can help. To get started,

contact us

online today.